A burgeoning trade war with China has led the U.S. government to continue investing in domestic production of certain minerals and materials, as reported in the annual United States Geological Survey Mineral Commodity Summaries.1

The USGS Mineral Commodity Summaries report spotlights events, trends, and issues from the past year in the nonfuel mineral industry. Each August, the ACerS Bulletin shares some of the key facts covered in the report.

In 2024, the total value of nonfuel mineral production in the United States was estimated to be $106 billion, an increase of nearly 1% from $105 billion in 2023. The total value of industrial minerals production was $72.1 billion, which is no change from the revised total of 2023. Of this total, $38 billion came from construction aggregates production, including construction sand, gravel, and crushed stone. Crushed stone accounted for the largest share of total U.S. nonfuel mineral production value in 2024 with 24%.

Continuing the trend from last year, the metals sector saw significant decreases in production due to global oversupply. Metals such as cobalt, lithium, and nickel saw decreases of 40–60% compared to 2023 as many other metal-producing countries reduced prices. On the other hand, the industrial minerals sector again saw increased production values for aggregates due to higher prices.

As a continuation of the U.S. government’s goals to expand the domestic mining sector, several congressional acts, investments, and projects were passed or launched in 2024. For example, the Department of Defense (DOD) awarded more than $400 million through the Defense Production Act Investments program to U.S.-based projects that aim to establish domestic manufacturing capacities for critical minerals production. The DOD also announced awards of more than $40 million to Canadian companies to support the United States–Canada Joint Action Plan on Critical Minerals.

Even with these developments, the U.S. still relies heavily on foreign sources for certain raw and processed mineral materials. In 2024, the U.S. was 100% reliant on 12 out of 50 individually listed critical minerals, as well as more than 50% net import reliant on 28 more critical mineral commodities. The recycling of antimony, bismuth, chromium, germanium, magnesium metal, tin, tungsten, and vanadium served as the only source of domestic supply for these materials.

The five-year period of 2020–2024 showed declined consumption for many mineral commodities. This decline indicates some substitutions may be in use for certain materials or that less products are being produced with raw mineral commodities. The largest decreases of more than 25% were seen with thallium, asbestos, bauxite, bismuth, industrial diamond (stones), and strontium.

Considering these trends, the U.S. Department of Energy announced a $75 million project in April 2024 to construct a Critical Minerals Supply Chain Research Facility funded by the Bipartisan Infrastructure Law.2 Moreover, legislation such as the Critical Minerals Security Act of 20243 and National Critical Minerals Council Act4 were introduced to help keep track of all global critical mineral and rare earth element activities and implement a national critical minerals strategy, respectively.4

Regarding the ongoing trade war with China, in May 2024, President Joe Biden raised tariffs on electric vehicles, solar cells, steel, aluminum, and metal equipment from China.5 That December, China issued export bans on antimony, gallium, and germanium.6 In response, the United States Trade Representative began a Section 301 investigation on China regarding their dominant role in the semiconductor industry.

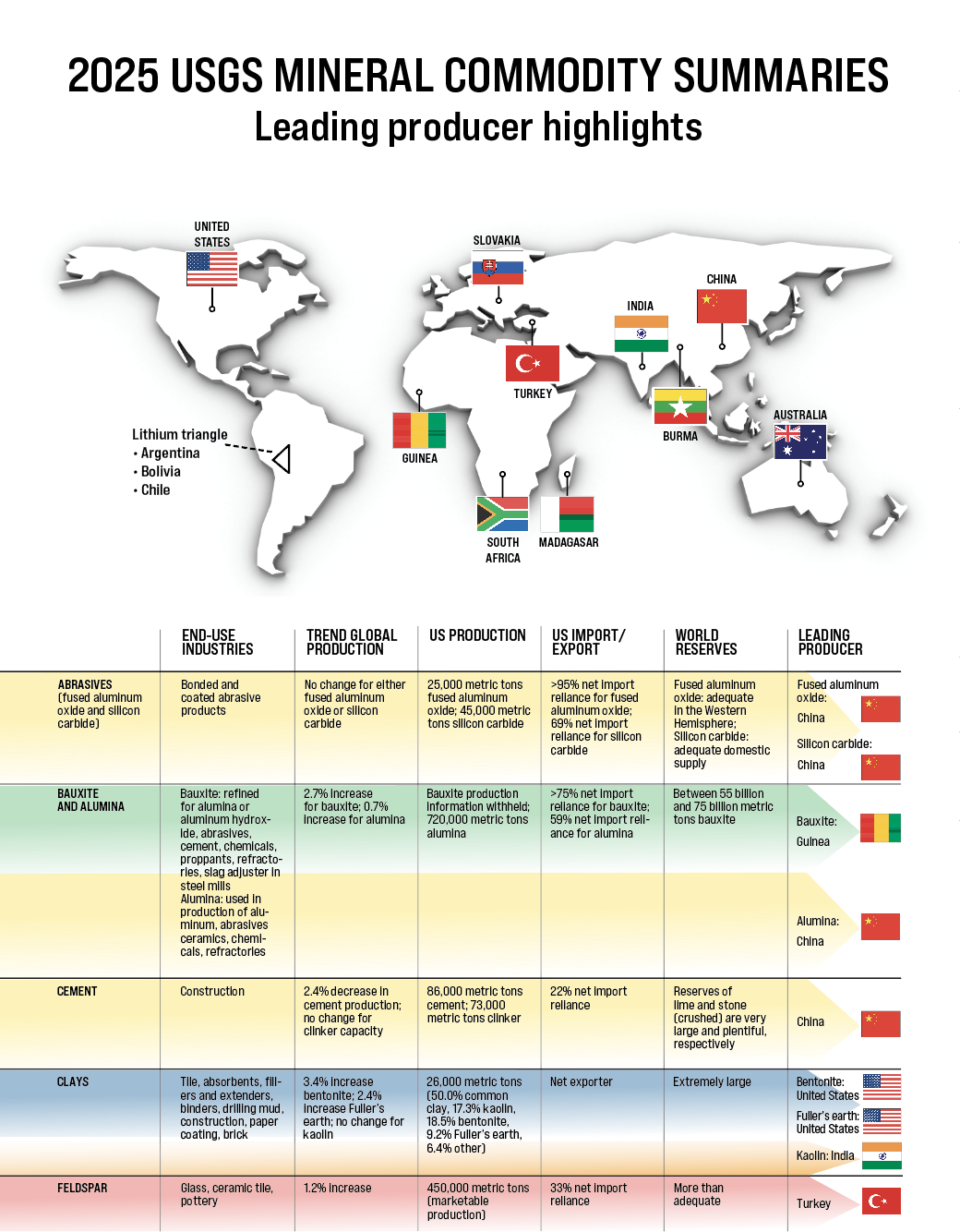

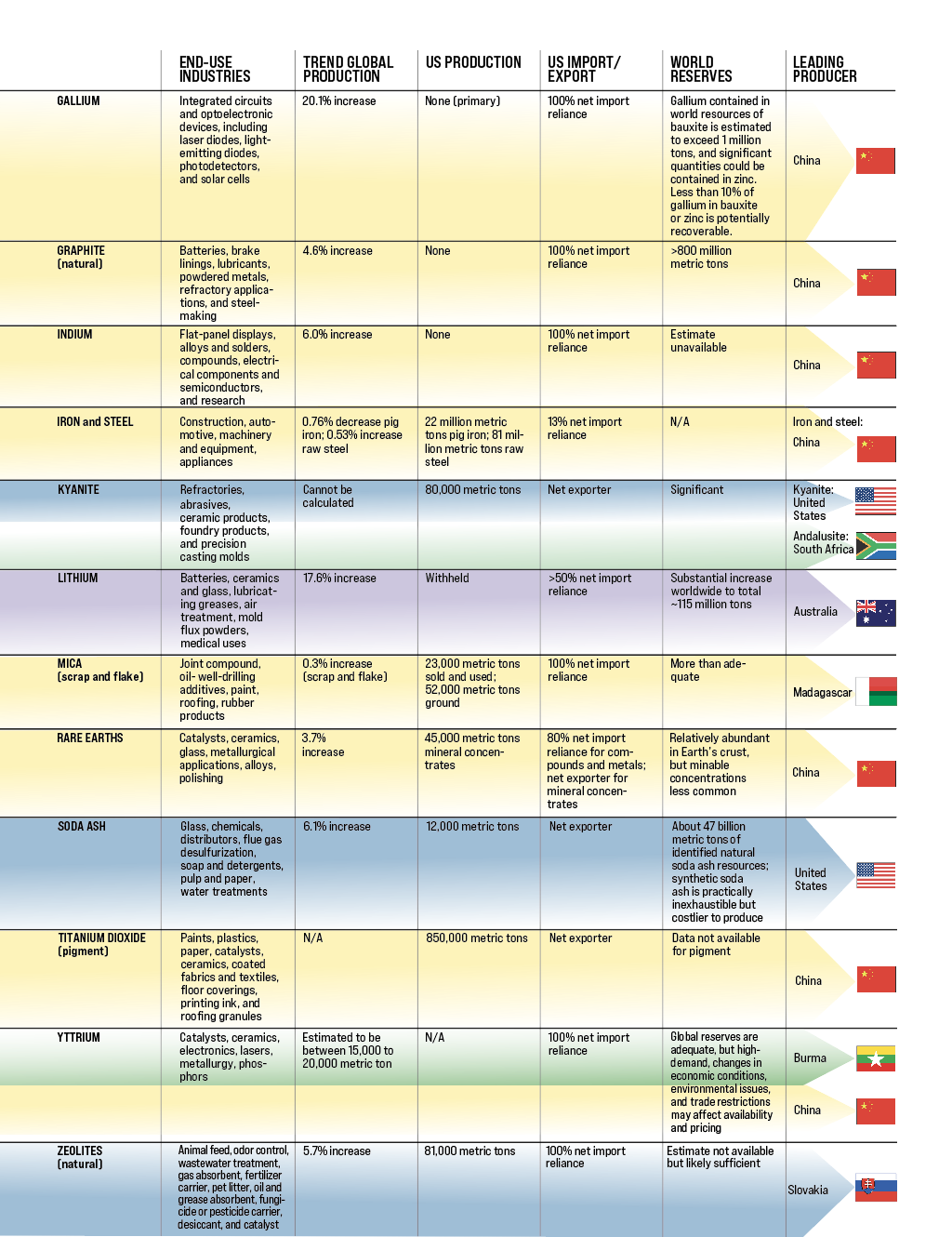

The table below summarizes some of the statistics and trends for a variety of mineral commodities that serve the ceramic and glass industries. Access the complete USGS report at https://doi.org/10.3133/mcs2025.

1Mineral Commodity Summaries 2025, U.S. Geological Survey, Reston, Va., 2025.

2“DOE’s top clean energy accomplishments in 2024,” Department of Energy, 23 Dec. 2024.

3“S.3631–118th Congress (2023–2024): Critical Minerals Security Act of 2024.” Congress.gov. Published 21 Nov. 2024.

4“S.5030–118th Congress (2023–2024): National Critical Minerals Council Act.” Congress.gov. Published 12 Sept. 2024.

5S. Mistreanu, “A timeline of US-China tit-for-tat tariffs since Trump’s first term,” AP News. Published 10 Feb. 2025.

6A. Lv and T. Munroe, “China bans export of critical minerals to US as trade tensions escalate,” Reuters. Published 3 Dec. 2024.

*All references verified as of June 19, 2025.

Cite this article

H. Widman, “US government expands domestic supply chain efforts amid trade strains,” Am. Ceram. Soc. Bull. 2025, 104(6): 47–49.

About the Author(s)

Helen Widman is content coordinator at The American Ceramic Society (Westerville, Ohio). Contact Widman at hwidman@ceramics.org.

Issue

Category

- Art, archeology, and conservation science

- Energy materials and systems

Related Articles

Market Insights

Engineered ceramics support the past, present, and future of aerospace ambitions

Engineered ceramics play key roles in aerospace applications, from structural components to protective coatings that can withstand the high-temperature, reactive environments. Perhaps the earliest success of ceramics in aerospace applications was the use of yttria-stabilized zirconia (YSZ) as thermal barrier coatings (TBCs) on nickel-based superalloys for turbine engine applications. These…

Market Insights

Aerospace ceramics: Global markets to 2029

The global market for aerospace ceramics was valued at $5.3 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 8.0% to reach $8.2 billion by the end of 2029. According to the International Energy Agency, the aviation industry was responsible for 2.5% of…

Market Insights

Innovations in access and technology secure clean water around the world

Food, water, and shelter—the basic necessities of life—are scarce for millions of people around the world. Yet even when these resources are technically obtainable, they may not be available in a format that supports healthy living. Approximately 115 million people worldwide depend on untreated surface water for their daily needs,…